Imagine a world where financial predictions are no longer just educated guesses, but near-certainties shaped by unimaginable computational power. That’s the promise of quantum computing, a technology that’s beginning to redefine how we assess uncertainty in markets. Quantum risk models, built on the staggering capabilities of quantum algorithms, are poised to transform industries like finance, insurance, and beyond. They don’t just crunch numbers faster; they tackle problems traditional computers can’t even approach. As Wall Street buzzes with cautious excitement, and tech hubs from Silicon Valley to Boston race to integrate these tools, one thing is clear: the way we understand and manage risk is on the cusp of a revolution. This isn’t science fiction—it’s a shift unfolding in 2025, and it’s already raising big questions about accuracy, ethics, and access.

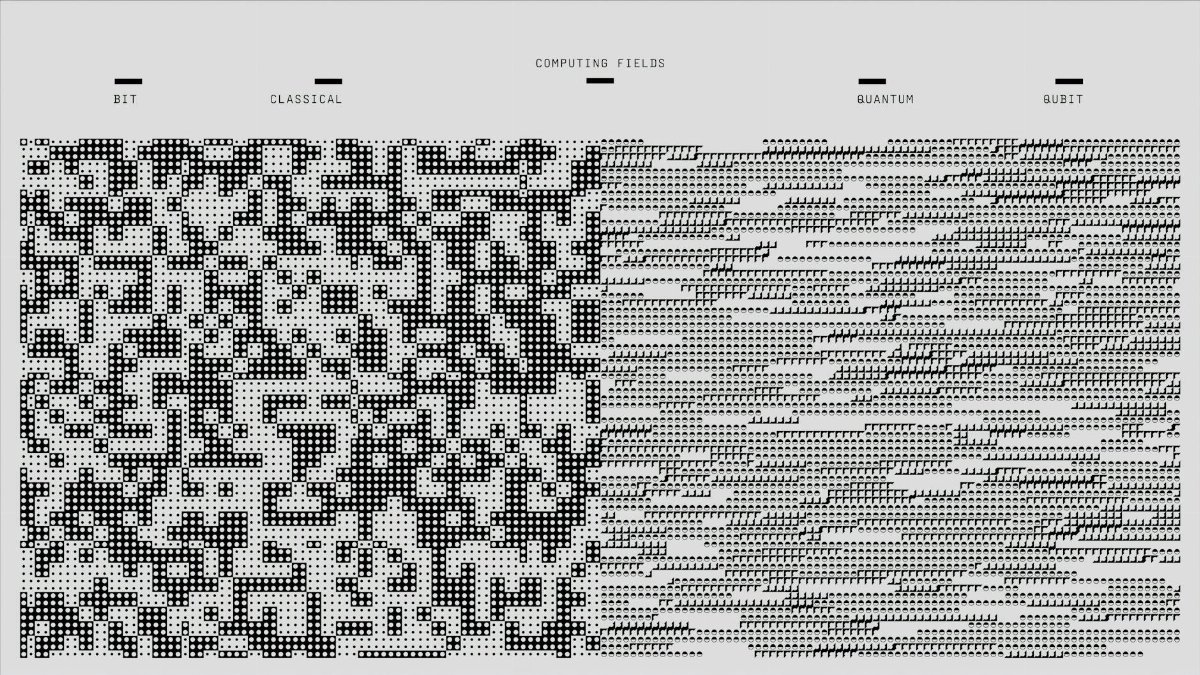

The Quantum Leap in Computing Power

Quantum computing isn’t just a faster version of the laptops we use daily. It operates on principles of quantum mechanics—think superposition and entanglement—that allow it to process vast arrays of possibilities simultaneously. For risk modeling, this means analyzing complex financial portfolios or insurance scenarios in ways classical computers, even supercomputers, struggle with. A traditional model might take days to simulate market downturns across thousands of variables. A quantum system could, in theory, do it in minutes or seconds.

This isn’t mere hype. Research from institutions like MIT shows quantum algorithms can solve optimization problems—key to risk assessment—at speeds unattainable by classical methods. A study from the MIT News Office highlights early successes in financial simulations. But the technology is still young. Most quantum computers today are experimental, and their error rates can frustrate even the most patient analysts. Still, the potential is undeniable.

How Quantum Risk Models Work

At their core, quantum risk models leverage quantum algorithms to evaluate probabilities across countless scenarios. Picture a portfolio manager trying to predict how a mix of stocks, bonds, and derivatives might behave in a crisis. Classical models simplify the problem, often missing subtle correlations. Quantum systems, by contrast, can map out intricate interdependencies using algorithms like the Quantum Monte Carlo method.

The result? A more granular view of risk. As explained in a report by the IBM Institute for Business Value, quantum models could spot hidden vulnerabilities in portfolios that traditional tools overlook. Yet, there’s a catch: interpreting these results demands expertise that’s in short supply. The math is dense, and the outputs aren’t always intuitive. For now, it’s a tool for specialists, not the average investor.

Revolutionizing Financial Markets

In the high-stakes world of finance, quantum risk models could be a game-changer. Hedge funds and investment banks are already investing heavily in quantum research, eager to gain an edge. Imagine a trading firm using quantum simulations to stress-test strategies across millions of market conditions in real time. The advantage isn’t just speed—it’s precision. A paper from Nature details how quantum approaches can optimize risk-return trade-offs far beyond classical limits.

But it’s not all smooth sailing. During a recent industry conference, one portfolio manager shared a concern echoed by many: “We’re pouring millions into quantum tech, but if the models spit out results we can’t explain to clients, trust erodes fast.” The challenge isn’t just technical—it’s about translating quantum insights into actionable, transparent decisions. For now, early adopters are treading carefully.

Insurance and Beyond: Wider Applications

Finance isn’t the only sector eyeing quantum risk models. Insurance companies, for instance, face monumental challenges in predicting rare but catastrophic events—think hurricanes or pandemics. Classical models often rely on historical data, which can lag behind emerging threats like climate change. Quantum systems, with their ability to simulate complex systems, could help insurers price policies more accurately and prepare for black-swan events.

A report by the McKinsey & Company suggests quantum tools might redefine actuarial science within a decade. One actuary, speaking anonymously at a recent forum, described the shift as “like moving from a sketch to a high-definition map.” Yet, the cost of quantum hardware and the scarcity of skilled professionals remain hurdles. For smaller firms, the revolution feels distant.

Ethical Dilemmas and Access Gaps

As quantum risk models advance, they bring thorny ethical questions. Who gets access to this power? Right now, the technology is concentrated in the hands of tech giants and well-funded institutions. Smaller players—think community banks or regional insurers—risk being left behind, widening existing inequalities in finance. If quantum tools can predict market shifts with uncanny accuracy, they could also exacerbate volatility if misused.

There’s also the issue of accountability. If a quantum model’s prediction leads to a disastrous investment, who’s to blame—the algorithm, the programmer, or the firm? These aren’t abstract worries. Online discussions often reveal unease among professionals about “black box” systems that defy easy explanation. As one commenter put it, the fear is “relying on a machine we don’t fully understand.” Balancing innovation with fairness and transparency will be critical in 2025 and beyond.

Barriers to Adoption in 2025

Despite the excitement, quantum risk models aren’t ready for prime time. The hardware itself is a bottleneck—quantum computers require extreme conditions, like near-absolute-zero temperatures, to function. They’re also prone to errors, a problem known as “quantum noise.” For every breakthrough, there’s a reminder of how far we have to go. Building a workforce skilled in quantum mechanics and risk analysis is another hurdle. Universities are ramping up programs, but demand outpaces supply.

Then there’s the cost. Developing or even accessing quantum systems can run into millions, a price tag that excludes most firms. For mid-sized companies, the question isn’t just “Can we afford it?” but “Can we afford to wait?” The gap between promise and practicality remains wide, though steady progress keeps hope alive.

The Human Element in a Quantum World

Amid all the talk of algorithms and qubits, it’s easy to forget the human side of risk modeling. At a recent tech meetup in Chicago, a data scientist described the awe of watching a quantum simulation unfold, only to realize the results still needed a human touch to make sense for real-world decisions. “It’s not magic,” she said quietly to a colleague. “It’s a tool, and we’re still the ones steering.”

That’s the crux. Quantum risk models amplify our ability to analyze uncertainty, but they don’t replace judgment. They can highlight a portfolio’s weak spots or flag an impending crisis, but the call to act—whether to sell, hold, or double down—remains ours. As this technology matures, the interplay between machine precision and human intuition will shape its true impact.

What Lies Ahead for Risk Management

Looking forward, the trajectory of quantum risk models seems both thrilling and uncertain. Experts predict that within a decade, hybrid systems—combining classical and quantum approaches—could become standard in major industries. But timelines are slippery. What’s certain is that the stakes are high. If harnessed responsibly, quantum tools could make markets more stable and predictions more reliable. If not, they risk becoming another source of disparity or disruption.

For everyday investors or business owners, the impact might not be immediate. Yet, staying informed matters. As quantum computing reshapes risk assessment, it will subtly influence everything from loan rates to insurance premiums. The revolution is coming—quietly for now, but with a force that’s hard to ignore. Keeping an eye on its evolution isn’t just prudent; it’s essential.

With a career spanning investment banking to private equity, Dominik brings a rare perspective on wealth. He explores how money can be a tool for personal freedom and positive impact, offering strategies for abundance that align with your values.

Disclaimer

The content on this post is for informational purposes only. It is not intended as a substitute for professional health or financial advice. Always seek the guidance of a qualified professional with any questions you may have regarding your health or finances. All information is provided by FulfilledHumans.com (a brand of EgoEase LLC) and is not guaranteed to be complete, accurate, or reliable.