Is remote stipend tax free really the game-changer workers and employers think it is? As remote work remains a staple in 2025, more companies are offering stipends to cover home office expenses. But the catch lies in whether these payments can truly be classified as tax-free benefits under U.S. law. Employees are eager to maximize their take-home pay, while businesses aim to attract talent with creative perks. This article breaks down the rules, challenges, and strategies for negotiating a remote stipend that won’t get eaten up by the IRS.

Understanding IRS Rules on Tax-Free Stipends

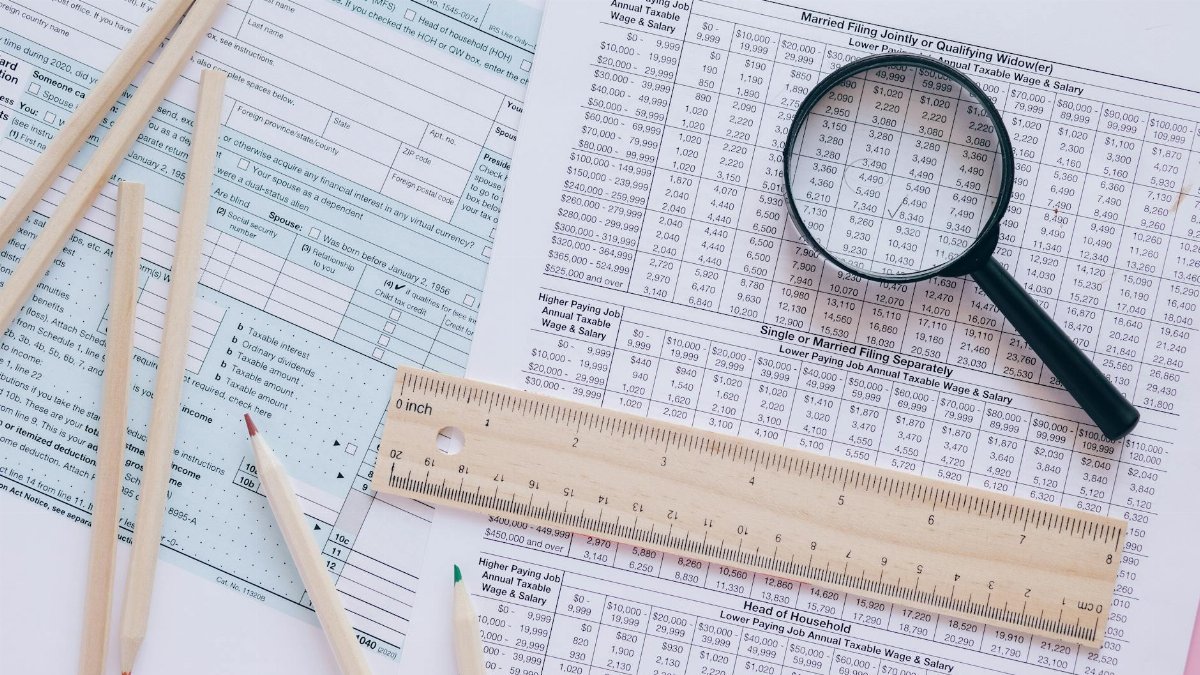

The IRS has strict guidelines on what qualifies as a tax-free benefit. Under Section 132 of the Internal Revenue Code, certain fringe benefits, like de minimis benefits, can be excluded from taxable income. However, remote stipends often fall into a gray area. If the stipend is deemed compensation for services rather than a reimbursement for specific expenses, it’s taxable. Employees and employers must ensure stipends are tied to documented work-from-home costs to stand a chance at tax-free status.

Why Companies Offer Remote Stipends

With remote work still dominant in 2025, companies use stipends as a competitive edge to attract and retain talent. These payments, often ranging from $50 to $200 monthly, help cover internet, utilities, or equipment costs. Offering a remote stipend tax free—or at least positioning it as such—can sweeten the deal for employees wary of extra tax burdens. It’s a strategic move for businesses facing tight labor markets and rising demands for flexible work arrangements.

Documenting Expenses for Tax-Free Status

To classify a remote stipend as tax-free, documentation is key. Employees must track and submit receipts for home office expenses like internet bills or ergonomic chairs. Without proof, the IRS can reclassify the stipend as taxable income. Employers should set clear policies requiring itemized expense reports to protect both parties during audits. The more specific the records, the stronger the case for keeping these benefits off the tax radar.

Common Pitfalls in Stipend Agreements

One major snag is miscommunication between employers and workers. If a company labels a stipend as “tax-free” without meeting IRS criteria, employees could face unexpected tax bills. Another issue is overgeneralized payments—lump sums not tied to specific costs are almost always taxable. Both sides need to understand the fine print to avoid penalties or disputes with tax authorities down the line.

Negotiating a Stipend That Works for You

Employees should push for stipends structured as reimbursements rather than flat bonuses. Request a policy that ties payments to actual expenses, and ask for clarity on reporting requirements. If a company balks at guaranteeing a remote stipend tax free, negotiate for a higher amount to offset potential taxes. Data from the Bureau of Labor Statistics shows remote work benefits are increasingly central to job satisfaction in 2025.

Employer Responsibilities and Risks

Companies offering remote stipends must navigate compliance with federal and state tax laws. Failing to report taxable stipends can lead to fines or legal headaches. Employers should consult tax professionals to structure these benefits correctly. Resources from the IRS Small Business Guide provide detailed guidance on fringe benefits and taxable income rules, helping businesses stay on the right side of the law.

State-Level Variations to Watch

Tax treatment of remote stipends isn’t uniform across the U.S. Some states, like California, have stricter rules on what qualifies as a tax-free benefit, while others may offer more leniency. Remote workers crossing state lines for their jobs face additional complexity, as they might owe taxes in multiple jurisdictions. Both employees and employers need to research state-specific regulations to avoid surprises at tax time.

Future of Remote Stipends in Tax Policy

As remote work evolves, so might tax policies surrounding stipends. Advocacy groups are pushing for clearer federal guidelines to make remote benefits consistently tax-free, especially for essential expenses. Until then, workers and companies must stay proactive, keeping up with IRS updates and legislative changes in 2025. The debate over taxable versus non-taxable benefits is far from settled, but it’s clear that remote stipends are here to stay as a workplace norm.

With a career spanning investment banking to private equity, Dominik brings a rare perspective on wealth. He explores how money can be a tool for personal freedom and positive impact, offering strategies for abundance that align with your values.

Disclaimer

The content on this post is for informational purposes only. It is not intended as a substitute for professional health or financial advice. Always seek the guidance of a qualified professional with any questions you may have regarding your health or finances. All information is provided by FulfilledHumans.com (a brand of EgoEase LLC) and is not guaranteed to be complete, accurate, or reliable.