Imagine a world where the stock market isn’t just a numbers game, but a reflection of values. Across the United States, from Wall Street to small-town investment clubs, a growing number of investors are tuning into something beyond profit margins. They’re asking: Can we make money while making a difference? This is where ethical market timing esg comes into play—a strategy that blends the precision of market entry and exit with a commitment to environmental, social, and governance (ESG) principles. It’s not a fleeting trend. It’s a response to a deeper demand for accountability in 2025, as more Americans seek to align their portfolios with their ethics. This shift isn’t just reshaping personal wealth strategies; it’s redefining how we view success in the financial world. Welcome to a new era of investing, where timing meets purpose through innovative tools like ESG signal dashboards.

The Rise of Ethical Market Timing

A decade ago, market timing was often seen as a cold, calculated game—buy low, sell high, repeat. But something has shifted. Investors are increasingly weaving ethical considerations into their decisions, spurred by a heightened awareness of corporate impact on the planet and society. Ethical market timing esg emerged as a way to synchronize entry and exit points with ESG performance metrics. It’s about waiting for the right moment—not just for profit, but for alignment with sustainable practices.

Take, for instance, a retiree in Ohio who shared a striking perspective at a recent community finance workshop. “I don’t want my savings tied to companies polluting the air my grandkids breathe,” she said, her voice firm. Her sentiment echoes a broader movement. According to a 2023 report from Pew Research Center, 72% of U.S. workers say a company’s ESG policies influence their career choices. That same logic is spilling into investment strategies, driving demand for tools that signal when a company’s ESG scores match market opportunities.

Decoding ESG Signal Dashboards

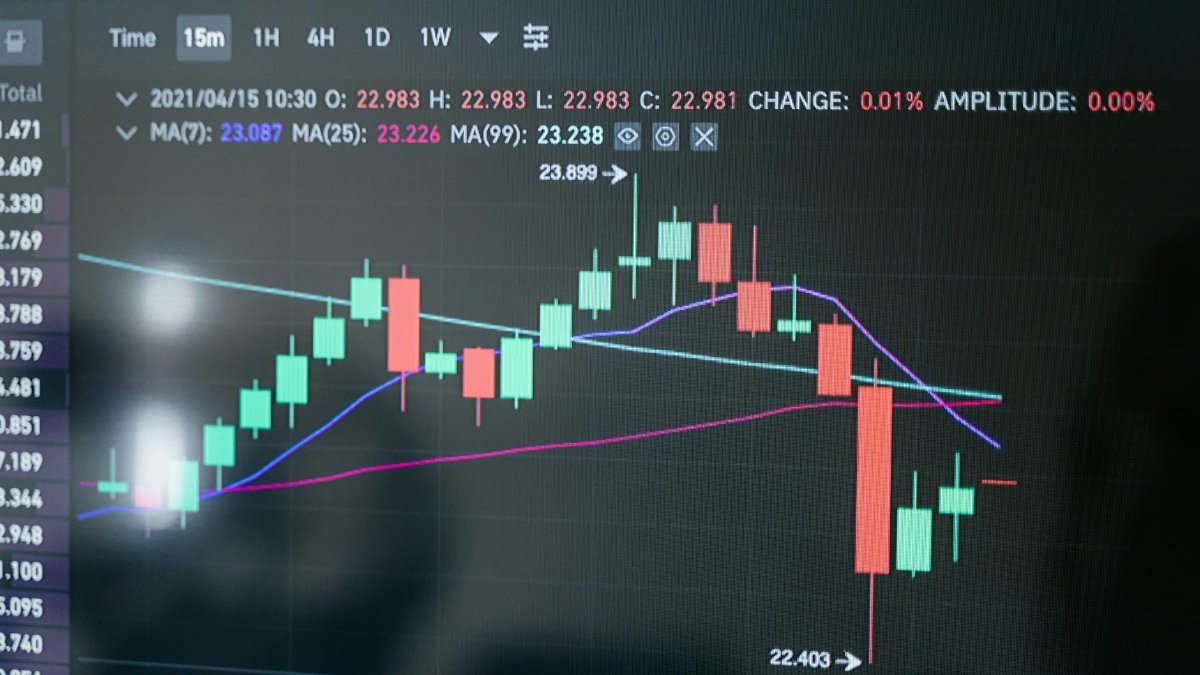

At the heart of this approach are ESG signal dashboards—digital platforms that provide real-time data on a company’s environmental footprint, social responsibility, and governance standards alongside traditional financial indicators. Think of them as a compass for the modern investor. These tools aggregate scores from multiple sources, offering a snapshot of whether a firm is, say, reducing carbon emissions or improving board diversity, while also flagging optimal buy or sell windows.

A standout example is how dashboards pull data from reports like those published by MSCI ESG Research. Investors can see a company’s rating shift after a major policy change, prompting a timely decision. For someone managing a modest portfolio, this transparency is a game-changer. It’s no longer just Wall Street insiders who have access to actionable insights; it’s anyone with a smartphone and a desire to invest with intention.

Balancing Profit and Principles

Here’s the rub: ethical market timing esg isn’t a guarantee of outsized returns. Aligning investments with ESG criteria can sometimes mean passing on high-growth opportunities tied to less scrupulous industries. A tech startup might skyrocket in value, but if its labor practices are questionable, an ESG-focused investor might hesitate. Data from a 2022 study by Harvard Business School suggests that while ESG-aligned portfolios often perform comparably to traditional ones over the long term, short-term volatility can test an investor’s resolve.

Yet, there’s a quiet strength in this restraint. It’s about redefining wealth—not just as dollars in the bank, but as a legacy of choices that reflect personal values. For many middle-aged Americans, who’ve seen economic booms and busts, this balance feels like a way to regain control over their financial footprint.

The Emotional Pull of Ethical Investing

Investing isn’t just a cerebral exercise; it’s deeply personal. There’s a visceral satisfaction in knowing your money supports renewable energy or fair labor practices. One anonymous account shared in online discussions captured this perfectly: “Seeing my portfolio grow while backing companies that care about the planet—it’s like I’m part of something bigger.” That emotional resonance is a powerful driver behind ethical market timing esg, especially for those in their 40s and 50s who are often reassessing their life’s impact.

This isn’t mere sentimentality. It’s backed by numbers. A 2024 survey from Morningstar found that 68% of U.S. investors feel more confident in their financial decisions when ESG factors are considered. Dashboards amplify this by making those factors visible, turning abstract ideals into concrete data points you can act on.

Challenges in the ESG Timing Game

Not everything is seamless. One hurdle is the inconsistency in ESG ratings across platforms. A company might score high on one dashboard for its environmental efforts but low on another due to governance issues. This discrepancy can paralyze decision-making. Then there’s the risk of “greenwashing”—companies exaggerating their ethical credentials to attract investors. Sifting through the noise requires diligence, and not every investor has the time or expertise.

Still, the frustration isn’t a dealbreaker. It’s a call to action. Many are learning to cross-reference dashboard data with independent reports or lean on community forums for insights. The process isn’t perfect, but it’s evolving, much like the investors who embrace it. In 2025, as more tools refine their algorithms, the hope is for greater clarity in navigating these murky waters.

Practical Steps to Get Started

Curious about dipping a toe into ethical market timing esg? Start small. First, explore ESG dashboards like those offered by major financial platforms—many provide free trial access to their basic features. Set aside an hour to familiarize yourself with the metrics that matter most to you. Is it carbon neutrality? Workplace equity? Narrow your focus.

Next, allocate a portion of your portfolio—say, 10%—to test the waters. Track how ESG signals correlate with market movements over a few months. Speak with a financial advisor if the stakes feel high; they can help tailor your approach. The goal isn’t to overhaul your strategy overnight but to build a rhythm that feels authentic. Over time, as confidence grows, so might your commitment to aligning timing with values.

A Broader Impact on Wealth Culture

Zoom out, and the implications of this trend ripple far beyond individual portfolios. Ethical market timing esg is quietly reshaping wealth culture in America. It’s pushing companies to prioritize sustainability and transparency, knowing investors are watching—and timing their moves accordingly. It’s also fostering a generational dialogue. Middle-aged investors are often mentoring younger family members, passing down not just funds but a mindset of responsibility.

Consider a family in Seattle, where a father and daughter recently sat down to review their joint investments. “We’re not just building wealth; we’re building a world we want to live in,” the father explained, as they adjusted their holdings based on ESG dashboard alerts. Such moments hint at a larger shift—a reimagining of what financial success looks like in 2025, where ethics and timing walk hand in hand.

With a career spanning investment banking to private equity, Dominik brings a rare perspective on wealth. He explores how money can be a tool for personal freedom and positive impact, offering strategies for abundance that align with your values.

Disclaimer

The content on this post is for informational purposes only. It is not intended as a substitute for professional health or financial advice. Always seek the guidance of a qualified professional with any questions you may have regarding your health or finances. All information is provided by FulfilledHumans.com (a brand of EgoEase LLC) and is not guaranteed to be complete, accurate, or reliable.